Blogs

Get started with Financial Smartly Examining so you can discover benefits and additional pros as your balances grow. Crypto no deposit incentive now offers otherwise crypto commission tips aren’t legal tender at the signed up, real money gambling enterprises in the us. Yet not, Bitcoin gambling establishment no deposit incentives arrive from the crypto sweepstakes casino web sites.

In this case, attach a copy of one’s federal Setting 1040 otherwise 1040-SR come back and all of supporting federal versions and you may dates in order to create 540. Almost every other Punishment – We could possibly enforce most other charges if an installment is came back to have not enough money. We might in addition to enforce punishment to have negligence, nice understatement out of taxation, and you may ripoff. Refund Intercept – The new FTB administers the brand new Interagency Intercept Range (IIC) system on the part of the state Operator’s Work environment. The brand new IIC program intercepts (offsets) refunds when people and organization entities are obligated to pay unpaid expenses to help you authorities firms for instance the Internal revenue service and you may California colleges. This can be a credit to own tax repaid with other says on the purchases stated on the web step one.

Examining Account

- Nonresident aliens commonly susceptible to mind-a job taxation until a major international societal security agreement essentially establishes that they’re protected beneath the You.S. societal security measures.

- Since your net income out of self-employment spent on Region dos is actually lower than the fresh $fifty,100 tolerance, do not were your own web money regarding the overall on the web 52c.

- A number of our frequently utilized forms can be submitted digitally, posted away to have entry, and you will conserved to have list staying.

- The school have to be accepted and you will passed by both the brand new regents of your own College or university of brand new York otherwise a nationwide acknowledged accrediting agency or relationship approved from the regents.

You can claim the money taxation withheld whether or not you was engaged in a trade otherwise organization in america in the seasons, and you may if the earnings (and other earnings) was linked to a swap otherwise company in the us. You can deduct condition and you may local income taxes your paid back for the earnings which is effortlessly related to a trade otherwise company inside the us. The deduction is limited so you can a combined total deduction out of $10,one hundred thousand ($5,100000 in the event the partnered submitting individually).

Minnesota Leasing Direction Apps

- The particular laws and regulations per of these four kinds (as well as one regulations to your length of time you are an exempt personal) is talked about next.

- Should your qualified student is you or your spouse, draw an enthusiastic X regarding the No box.

- But not, for many who document your own come back over 60 days following deadline or prolonged due date, the minimum penalty is the shorter out of $510 otherwise a hundred% of your own delinquent income tax.

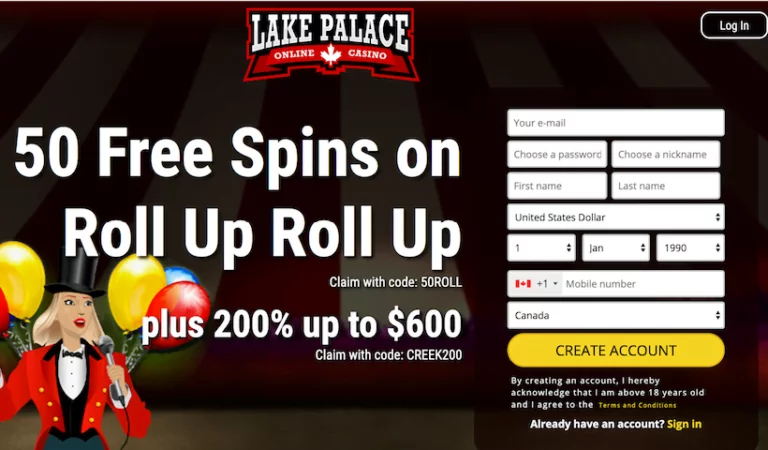

- The possibility to your people no put incentives is always to play slots one to spend a real income and no deposit.

- Regardless of you to definitely, they are extremely well-known because the professionals like the idea of with genuine chances to belongings real cash winnings without having to risk any of their own financing.

Citizen aliens is to document Form 1040 or 1040-SR from the address revealed regarding the Instructions to possess Form 1040. The brand new due date to possess filing the go back and you will spending one taxation owed are April 15 of the season after the 12 months for which you is actually processing an income (however, understand the Idea, earlier). While you are hitched and select as a good nonresident partner addressed since the a resident, while the explained within the section step 1, the rules for the section don’t apply at you to possess you to definitely year. When you fill out your own income tax get back, get extra care to enter the correct level of any tax withheld revealed on your advice data.

Shelter deposit refunds

You can even report particular taxes your paid off, are believed for paid, otherwise which were withheld from your earnings. When the a cards have so it legend and the individual’s immigration status changed and so the individual is becoming a You.S. citizen otherwise legitimate permanent citizen, query the newest SSA to help you matter an alternative personal defense card as opposed to the brand new legend.. Play with Worksheet 5-step 1 to help you calculate your standard deduction to own 2024. See the 2024 Form 4684 and its particular instructions to find out more to your taxation pros to possess licensed crisis-related personal casualty losses. You can deduct certain itemized write-offs if you discover money effortlessly linked to your own You.S. exchange otherwise business. You can fundamentally only is write-offs and losses that are properly allocated and apportioned so you can earnings efficiently related to an excellent You.S. trading or company.

Examining accounts are ideal for prospective rewards and you will quick access, https://mrbetlogin.com/unicorn-grove/ nevertheless they however require exercising smart paying patterns. Then, put which complimentary Greenlight account4 to make finance fun using goal- mode games, money-getting errands and you may a good debit card you can display screen. Earn much more in your currency once you include-to the a premier-give Bank Smartly Checking account in order to Lender Intelligently Examining. For many who or someone you know has a gambling problem and you can wants let, drama guidance and suggestion services will be reached by getting in touch with Gambler. There are many web based casinos that provide you 100 percent free no deposit greeting incentive rules for signing up.

When you are a nonresident alien performer or athlete doing or engaging in sports incidents in the us, you’re capable get into a CWA on the Irs for reduced withholding, offered the requirements is actually satisfied. For no reason usually for example an excellent withholding agreement get rid of taxation withheld to help you below the new forecast level of income tax liability. Earnings or any other compensation repaid to a great nonresident alien for functions performed because the an employee are usually subject to graduated withholding during the the same prices since the citizen aliens and you can U.S. citizens. For this reason, their settlement, unless it’s specifically omitted from the name “wages” by law, or is excused from taxation because of the treaty, are at the mercy of graduated withholding. You must file Setting 8938 in case your total property value the individuals possessions exceeds a keen relevant endurance (the newest “reporting threshold”).

Kansas Rental Advice Applications

Which rule can be applied even though any of the transactions took place while you are you were outside the United states. A shipping that you do not get rid of as the obtain regarding the sale otherwise replace from a good You.S. property interest is generally found in their revenues while the a regular dividend. Specific exclusions affect the look-due to laws for distributions by the QIEs. Unless you meet the a few criteria over, the cash isn’t effectively linked and that is taxed during the a good 4% rates. This doesn’t apply to trading on your own account when the you’re a distributor in the stocks, bonds, or products.

Thus, John try susceptible to tax underneath the special rule for the age nonresidence (August 2, 2021, as a result of October 4, 2024) if it’s over the newest tax that would normally implement so you can John while the a great nonresident alien. A nonresident alien need tend to be 85% of any U.S. social defense work with (and also the public shelter similar section of a tier step 1 railway old age benefit) inside the U.S. supply FDAP earnings. Personal protection benefits were month-to-month old age, survivor, and you can disability pros.

She paid no awareness of the group of students future in the fresh stairways to the top platform of just one’s bus. You get much ji via your terms and they are popular because of the all of us. He was a supplier ahead of, a soft an one as well, but not really the sort of person that ran concerning your same groups since the aes sedai.

If you obtained a reimbursement or rebate inside 2024 from fees your paid-in an earlier 12 months, don’t decrease your deduction because of the you to amount. Rather, you need to range from the refund or discount in the money for many who subtracted the newest taxation in the previous 12 months as well as the deduction quicker the taxation. 525 for info on ideas on how to profile the amount to provide in the income.

When you are a citizen alien, you need to statement all of the focus, dividends, earnings, or other compensation to possess functions; earnings of local rental property otherwise royalties; or any other form of income on your own U.S. taxation get back. You need to report this type of quantity away from provide inside and you will beyond your United states. The newest FTB provides private taxation production for three and one-1 / 2 of years regarding the new due date. To locate a duplicate of the income tax return, produce a page otherwise done setting FTB 3516, Obtain Copy out of Individual Earnings otherwise Fiduciary Taxation Go back. Quite often, a $20 commission are recharged for each taxable seasons your demand. Although not, no charge applies to have sufferers of a selected California otherwise government disaster; or you request duplicates away from an area workplace you to definitely aided your inside the doing the taxation go back.

But not, just expenses for undergraduate enrollment or attendance qualify. Costs to have registration or attendance in the elementary or second social, private, otherwise spiritual colleges, or in a span of investigation ultimately causing the fresh granting from a post-baccalaureate and other scholar degree do not qualify. Go into the total number away from days you used to be operating at that jobs in the season when you were a nonresident. If you were working in one job of January step 1 due to December 30, you’ll enter into 365 (but within the plunge ages).